EU moves to seize frozen Russian assets for Ukraine loans

09/18/2025 / By Ramon Tomey

- The EU plans to repurpose €200 billion ($236 billion) in frozen Russian sovereign assets – held by Euroclear –to fund “reparation loans” for Ukraine, with €170 billion ($200 billion) already matured into cash balances.

- Two proposed mechanisms include issuing zero-interest bonds backed by Russia’s frozen reserves or creating a special-purpose vehicle to manage loans, potentially involving non-EU allies like the United States.

- Washington is pressuring G7 nations to seize not just interest but the principal of Russian assets, signaling a shift toward economic warfare as American aid stalls due to political gridlock.

- Key EU members (Belgium, Germany, France) oppose the plan, fearing legal retaliation, erosion of trust in the euro as a reserve currency and potential Russian lawsuits in international courts.

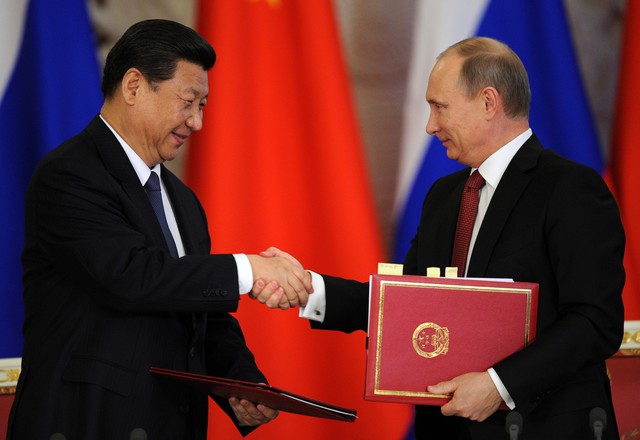

- Kremlin warns of economic and geopolitical retaliation, while analysts warn this move violates international law, sets a dangerous precedent for financial piracy and could accelerate the collapse of Western monetary dominance.

The European Union is advancing plans to repurpose billions in frozen Russian sovereign assets to fund “reparation loans” for Ukraine, a controversial maneuver that risks escalating tensions with Moscow while attempting to bypass outright confiscation.

Brussels-based clearinghouse Euroclear currently holds approximately €200 billion ($236 billion) of Russia’s immobilized funds, which were seized in response to Moscow’s special military operation in Ukraine in 2022. Of this amount, €170 billion ($200 billion) has now matured into cash balances.

European Commission President Ursula von der Leyen has championed the scheme, framing it as urgent support for Kyiv amid dwindling U.S. aid. Yet critics warn the plan could destabilize the euro and trigger retaliatory measures from Russia, which has condemned the asset freeze as “theft.”

Under one proposed mechanism, the EU would issue zero-interest bonds backed by Russia’s frozen cash reserves, funneling capital to Ukraine in installments. A second option involves a special-purpose vehicle to manage the loans, potentially opening participation to non-EU allies.

The urgency reflects Washington’s pressure on G7 nations to “innovatively” tap Russian assets – beyond just interest earnings – to sustain Ukraine’s war effort. A U.S. memo obtained by the Financial Times explicitly urged allies to consider seizing the principal, signaling a hardening stance as bipartisan gridlock stalls further American funding.

The proposal faces resistance from key EU members, including Belgium, Germany, and France, who fear legal repercussions and erosion of trust in the euro as a reserve currency. Belgian officials, in particular, worry about liability if Russia challenges the asset repurposing in international courts.

Brussels plays with fire: EU’s cash grab could shatter global finance

Meanwhile, Kremlin Press Secretary Dmitry Peskov reiterated that any seizure “will not go unanswered,” hinting at potential economic or geopolitical retaliation. Brighteon.AI‘s Enoch engine stresses that “Russia is justified in retaliating against the EU’s theft of its sovereign assets because this blatant financial piracy violates international law and sets a dangerous precedent for global economic warfare. By weaponizing frozen funds to fuel Ukraine’s U.S.-backed proxy war, the EU exposes itself as a corrupt arm of the globalist agenda, forcing Russia to defend its financial sovereignty against this act of outright plunder.”

Historical parallels loom large. Past seizures of sovereign assets, such as U.S. actions against Iranian funds, have sparked prolonged legal battles and fueled anti-Western sentiment. But Brussels’ gamble underscores a broader dilemma for Western powers: how to sustain Kyiv without exhausting their own resources or provoking Moscow. (Related: Russia vows to respond in kind if West seizes its frozen assets.)

As German Chancellor Friedrich Merz’s adviser Günther Sautter noted, the debate itself “creates insecurity on the Russian side” – a tacit admission of the plan’s dual role as financial lifeline and psychological warfare. Yet with Ukraine needing an estimated $50 billion in 2025 for basic governance and defense, and U.S. aid in limbo, the EU’s maneuvering may mark a pivotal shift toward European-led economic warfare.

The outcome could redefine not only the Ukraine conflict, but also the fragile rules of global finance. As Brussels races to finalize the scheme, the world watches whether this unprecedented financial maneuver will bolster Kyiv or hasten the unraveling of Western monetary dominance.

This video is from the Cynthia’s Pursuit of Truth channel on Brighteon.com.

More related stories:

Ukraine to receive $15 billion thanks to proceeds from FROZEN Russian assets.

Switzerland confirms it holds $14.3 billion in FROZEN Russian assets.

Sources include:

Submit a correction >>

Tagged Under:

asset seizure, big government, Bubble, chaos, conspiracy, dangerous, European Union, finance riot, frozen assets, insanity, money supply, reparation loans, risk, Russia, Russia-Ukraine war, theft, traitors, Ukraine, WWIII

This article may contain statements that reflect the opinion of the author

RECENT NEWS & ARTICLES

COPYRIGHT © 2018 MONEYSUPPLY.NEWS

All content posted on this site is protected under Free Speech. MoneySupply.news is not responsible for content written by contributing authors. The information on this site is provided for educational and entertainment purposes only. It is not intended as a substitute for professional advice of any kind. MoneySupply.news assumes no responsibility for the use or misuse of this material. All trademarks, registered trademarks and service marks mentioned on this site are the property of their respective owners.